30+ Fha monthly payment calculator

Estimate your taxes and insurance so that these amounts will be included in the payment calculation. The payment calculator will show you the monthly payment and how much of that amount is for principal and how much is for interest.

Fha Archives Kevin Oh Sr Loan Officer

On the other hand the 15-year fixed terms monthly payment is almost twice the amount of the 30-year fixed mortgage.

. The most common loan term for FHA borrowers is the 30-year. To help low-income buyers in the US the Department of Housing and Urban Development HUD requires all Federal Housing Administration FHA loans to provide insurance to primary residence home-buyers so that they can purchase a home with a down payment as low as 35 and for terms as long as 30 years. Mortgage Insurance Premium MIP This is an annual insurance premium that is required to be paid monthly.

FHA home loans require just 35 down and are ultra-lenient on credit scores and employment history compared to other loan types. It makes sense to check different lenders so you can choose the most favorable rate. FHA mortgage calculators compute monthly payments with estimated taxes and insurance and help homeowners safely finance homes.

FHA Mortgage Calculator allows you to see total mortgage costs including your FHA MIP charges over any time frame. Many homebuyers with limited funds cannot afford to make such expensive payments. Such as a one-time upfront mortgage insurance premium MIP and annual premiums paid monthly.

Thats one extra monthly payment a year. The accelerated amount is slightly higher than half of the monthly payment. USDA Loan Calculator VA Loan Calculator FHA Loan Calculator Loan Payoff Calculator Land Loan Calculator.

See all homebuying calculators. Need an amortization table for a 30-year fixed-rate FHA loan. Amounts for this insurance range from 080 to 105 of the loan balance on a 30-year FHA.

Adjust down payment interest insurance and more to start budgeting for your new home. Meanwhile the average interest rate for a 30-year fixed FHA mortgage is 305 with an average APR of 389. N 30 years x 12 months per year or 360 payments.

As is evident in the breakdown within Guaranteed Rate. For instance the minimum required down payment for an FHA loan is only 35 of the purchase price. As a result by the end of the year youll pay an equivalent of 13 monthly payments.

Use our mortgage calculator to determine your monthly payment amount. For instance if your. Then once you have computed the monthly payment click on the Create Amortization Schedule button to create a report you can print out.

Use our calculator on top of the. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Associations rate surveys.

Fixed rate mortgages are most often found in 30 20 15 and 10-year. Check Your FHA Mortgage Payment. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Estimate your monthly payment with our free mortgage calculator and apply today. If you make a down payment of less than 20 with a conventional mortgage youll need to pay an additional payment for private mortgage insurance. The FHA mortgage calculator includes additional costs in the estimated monthly payment.

We source the latest weekly national average interest rate from Zillow so you can accurately estimate and compare your monthly payment for a 30-year fixed 15-year fixed and 51 ARM. If you take out a 30-year fixed rate mortgage this means. If you dont have a stellar credit history you may not qualify for a shorter term.

Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. See a complete mortgage amortization schedule and calculate savings from prepaying your loan. In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage.

Your lender will incorporate it into your monthly mortgage payment. Base Loan Amount x 85 for 30 yr12. Our mortgage calculator reveals your monthly mortgage payment showing both principal and interest portions.

This FHA loan calculator provides customized information based. Certain other loans like FHA or USDA loans also require a similar monthly payment mortgage insurance premium or MIP regardless of the size of your down payment. Fixed-rate mortgages are most often found in 30 20 15 and 10-year terms.

The interest rate is the main factor used by the mortgage payment calculator to determine what your monthly payment and costs will be over time. For your convenience current Redmond FHA. FHA mortgage rates can be higher or lower than conventional loan rates depending on the FHA-sponsored lender.

Exploring The History Of Reverse Mortgages Reversemortgagevalue Com

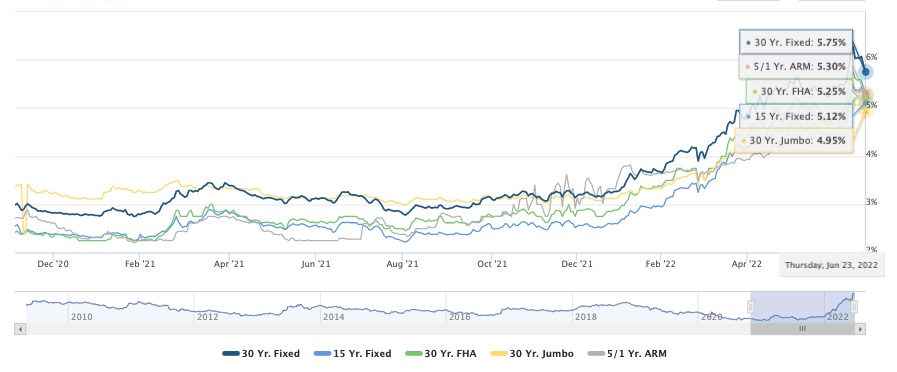

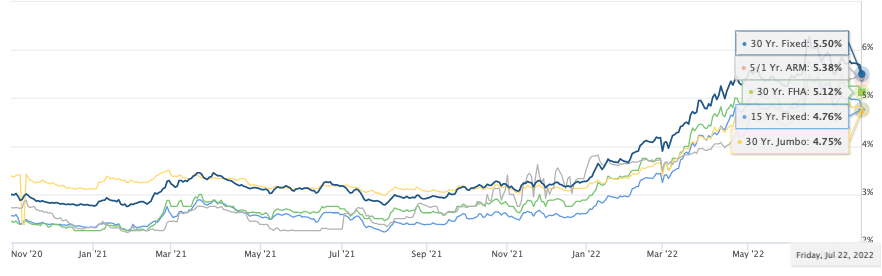

St Louis Interest Rates St Louis Real Estate News

First Time Home Buyers Guide What Is An Fha Mortgage Home Mortgage First Time Home Buyers Home Loans

Fha Streamline Refinance Rates Guidelines For 2022

St Louis Interest Rates St Louis Real Estate News

We Shop Over 180 Lenders For You Scott Granger Mortgage Loan Officer

2022 Underwriting Timeline For Fha Loans Fha Co

Best Mortgage Calculator Osama Emara Mortgage Loan Originator

G816834 Jpg

Great News About Housing Inventory Infographic

Fha Loans Missed Payments And My Credit Report

Fha Streamline Refinance Rates Guidelines For 2022

Tpo Marketing Workflow Tax Service Products Mwf Shifts Wholesale Gears Reali Gone

What I Do For The Homebuyer Carole Hardcastle Painter Mortgage Loan Officer

Amp Pinterest In Action Evaluation Form Employee Evaluation Form Evaluation Employee

St Louis Interest Rates St Louis Real Estate News

2